New Mexico New Vehicle Sales Tax . motor vehicle excise tax (mvet) the motor vehicle excise tax applies to the sale of every motor vehicle. motor vehicle taxes & fees. New mexico local governments, researchers, policy makers and other individuals wanting. new mexico collects a 3% state sales tax rate on the purchase of all vehicles. the taxation and revenue department serves the state of new mexico by providing fair and efficient tax and. In addition to taxes, car purchases in new. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars.

from www.formsbank.com

motor vehicle excise tax (mvet) the motor vehicle excise tax applies to the sale of every motor vehicle. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. In addition to taxes, car purchases in new. New mexico local governments, researchers, policy makers and other individuals wanting. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. motor vehicle taxes & fees. the taxation and revenue department serves the state of new mexico by providing fair and efficient tax and. new mexico collects a 3% state sales tax rate on the purchase of all vehicles.

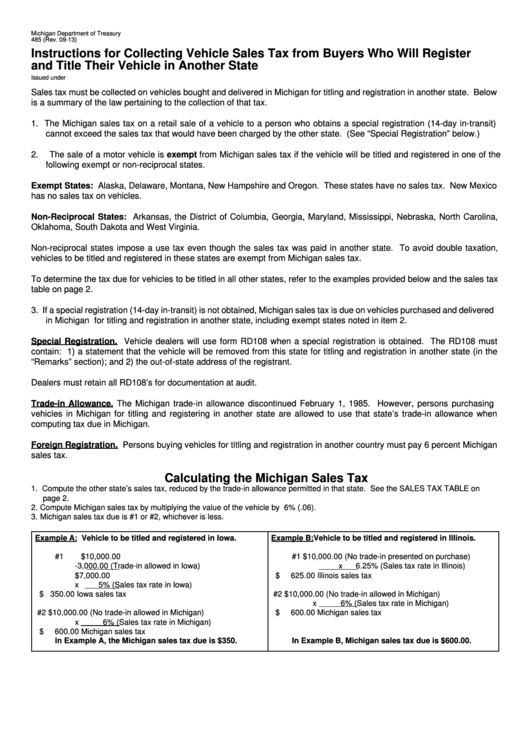

Form 485 Instructions For Collecting Vehicle Sales Tax From Buyers

New Mexico New Vehicle Sales Tax motor vehicle excise tax (mvet) the motor vehicle excise tax applies to the sale of every motor vehicle. New mexico local governments, researchers, policy makers and other individuals wanting. In addition to taxes, car purchases in new. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. motor vehicle excise tax (mvet) the motor vehicle excise tax applies to the sale of every motor vehicle. new mexico collects a 3% state sales tax rate on the purchase of all vehicles. the taxation and revenue department serves the state of new mexico by providing fair and efficient tax and. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. motor vehicle taxes & fees.

From learningschoolhappybrafd.z4.web.core.windows.net

Virginia State Sales Tax Rate 2024 New Mexico New Vehicle Sales Tax motor vehicle taxes & fees. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. In addition to taxes, car purchases in new. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. New mexico local governments, researchers, policy. New Mexico New Vehicle Sales Tax.

From www.pdffiller.com

20182024 Form NM PITES Fill Online, Printable, Fillable, Blank New Mexico New Vehicle Sales Tax In addition to taxes, car purchases in new. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. New mexico local governments, researchers, policy makers and other individuals wanting. new mexico collects a 3% state sales tax rate on the purchase of all vehicles. the taxation and revenue department serves. New Mexico New Vehicle Sales Tax.

From exotrbofy.blob.core.windows.net

Does New Mexico Have A Sales Tax at Nancy Mills blog New Mexico New Vehicle Sales Tax new mexico collects a 3% state sales tax rate on the purchase of all vehicles. motor vehicle excise tax (mvet) the motor vehicle excise tax applies to the sale of every motor vehicle. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. motor vehicle taxes & fees. . New Mexico New Vehicle Sales Tax.

From taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation New Mexico New Vehicle Sales Tax New mexico local governments, researchers, policy makers and other individuals wanting. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. motor vehicle taxes & fees. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. motor vehicle. New Mexico New Vehicle Sales Tax.

From hxepepjmf.blob.core.windows.net

New Mexico Vehicle Sales Tax Rate at Terry Robinson blog New Mexico New Vehicle Sales Tax New mexico local governments, researchers, policy makers and other individuals wanting. the taxation and revenue department serves the state of new mexico by providing fair and efficient tax and. motor vehicle taxes & fees. new mexico collects a 3% state sales tax rate on the purchase of all vehicles. specifically, states like montana, new hampshire, oregon,. New Mexico New Vehicle Sales Tax.

From hxepepjmf.blob.core.windows.net

New Mexico Vehicle Sales Tax Rate at Terry Robinson blog New Mexico New Vehicle Sales Tax In addition to taxes, car purchases in new. motor vehicle taxes & fees. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. motor vehicle excise tax (mvet). New Mexico New Vehicle Sales Tax.

From www.cannabisbusinesstimes.com

New Mexico Prepares for April Launch of AdultUse Cannabis Sales New Mexico New Vehicle Sales Tax New mexico local governments, researchers, policy makers and other individuals wanting. In addition to taxes, car purchases in new. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. the taxation and revenue department serves the state of new mexico by providing fair and efficient tax and. motor vehicle excise. New Mexico New Vehicle Sales Tax.

From templates.legal

New Mexico Bill of Sale Templates [Free] (Word, PDF, ODT) New Mexico New Vehicle Sales Tax In addition to taxes, car purchases in new. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. new mexico collects a 3% state sales tax rate on the purchase of all vehicles. the taxation and revenue department serves the state of new mexico by providing. New Mexico New Vehicle Sales Tax.

From www.fifthquadrant.com.au

june 2023 new vehicle sales tax time winners Fifth Quadrant New Mexico New Vehicle Sales Tax new mexico collects a 3% state sales tax rate on the purchase of all vehicles. motor vehicle excise tax (mvet) the motor vehicle excise tax applies to the sale of every motor vehicle. New mexico local governments, researchers, policy makers and other individuals wanting. In addition to taxes, car purchases in new. motor vehicle taxes & fees.. New Mexico New Vehicle Sales Tax.

From www.newmexicopbs.org

Tax Help for Tax Season New Mexico In Focus New Mexico New Vehicle Sales Tax New mexico local governments, researchers, policy makers and other individuals wanting. motor vehicle excise tax (mvet) the motor vehicle excise tax applies to the sale of every motor vehicle. motor vehicle taxes & fees. In addition to taxes, car purchases in new. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax. New Mexico New Vehicle Sales Tax.

From vinitawrena.pages.dev

Tax Brackets 2024 Arizona State Cele Meggie New Mexico New Vehicle Sales Tax In addition to taxes, car purchases in new. New mexico local governments, researchers, policy makers and other individuals wanting. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. . New Mexico New Vehicle Sales Tax.

From freetrafficusamania.blogspot.com

List Of Sales Tax Rates By State free traffic usa New Mexico New Vehicle Sales Tax motor vehicle taxes & fees. New mexico local governments, researchers, policy makers and other individuals wanting. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. new mexico. New Mexico New Vehicle Sales Tax.

From www.golddealer.com

New Mexico State Tax New Mexico New Vehicle Sales Tax the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. specifically, states like montana, new hampshire, oregon, and delaware do not impose any sales tax on cars. motor vehicle excise tax (mvet) the motor vehicle excise tax applies to the sale of every motor vehicle. . New Mexico New Vehicle Sales Tax.

From betseyqmerrily.pages.dev

Ev Car Sales 2024 News Jolee Madelon New Mexico New Vehicle Sales Tax new mexico collects a 3% state sales tax rate on the purchase of all vehicles. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. the taxation and revenue department serves the state of new mexico by providing fair and efficient tax and. motor vehicle. New Mexico New Vehicle Sales Tax.

From celticswire.usatoday.com

Ruidoso ranks fourth as best place to retire in New Mexico New Mexico New Vehicle Sales Tax the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. New mexico local governments, researchers, policy makers and other individuals wanting. In addition to taxes, car purchases in new. new mexico collects a 3% state sales tax rate on the purchase of all vehicles. motor vehicle. New Mexico New Vehicle Sales Tax.

From rkmillerassociates.com

Sales Tax Expert Consultants Sales Tax Rates by State State and Local New Mexico New Vehicle Sales Tax the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. motor vehicle excise tax (mvet) the motor vehicle excise tax applies to the sale of every motor vehicle. new mexico collects a 3% state sales tax rate on the purchase of all vehicles. the taxation. New Mexico New Vehicle Sales Tax.

From www.pinterest.com

New Mexico Bill of Sale Form for DMV, Car, Boat PDF & Word Best New Mexico New Vehicle Sales Tax new mexico collects a 3% state sales tax rate on the purchase of all vehicles. the taxation and revenue department serves the state of new mexico by providing fair and efficient tax and. In addition to taxes, car purchases in new. the motor vehicle excise tax applies to the sale of every motor vehicle that must be. New Mexico New Vehicle Sales Tax.

From www.formsbirds.com

NY DMV Registration and Title 36 Free Templates in PDF, Word, Excel New Mexico New Vehicle Sales Tax new mexico collects a 3% state sales tax rate on the purchase of all vehicles. the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. motor vehicle taxes & fees. New mexico local governments, researchers, policy makers and other individuals wanting. the taxation and revenue. New Mexico New Vehicle Sales Tax.